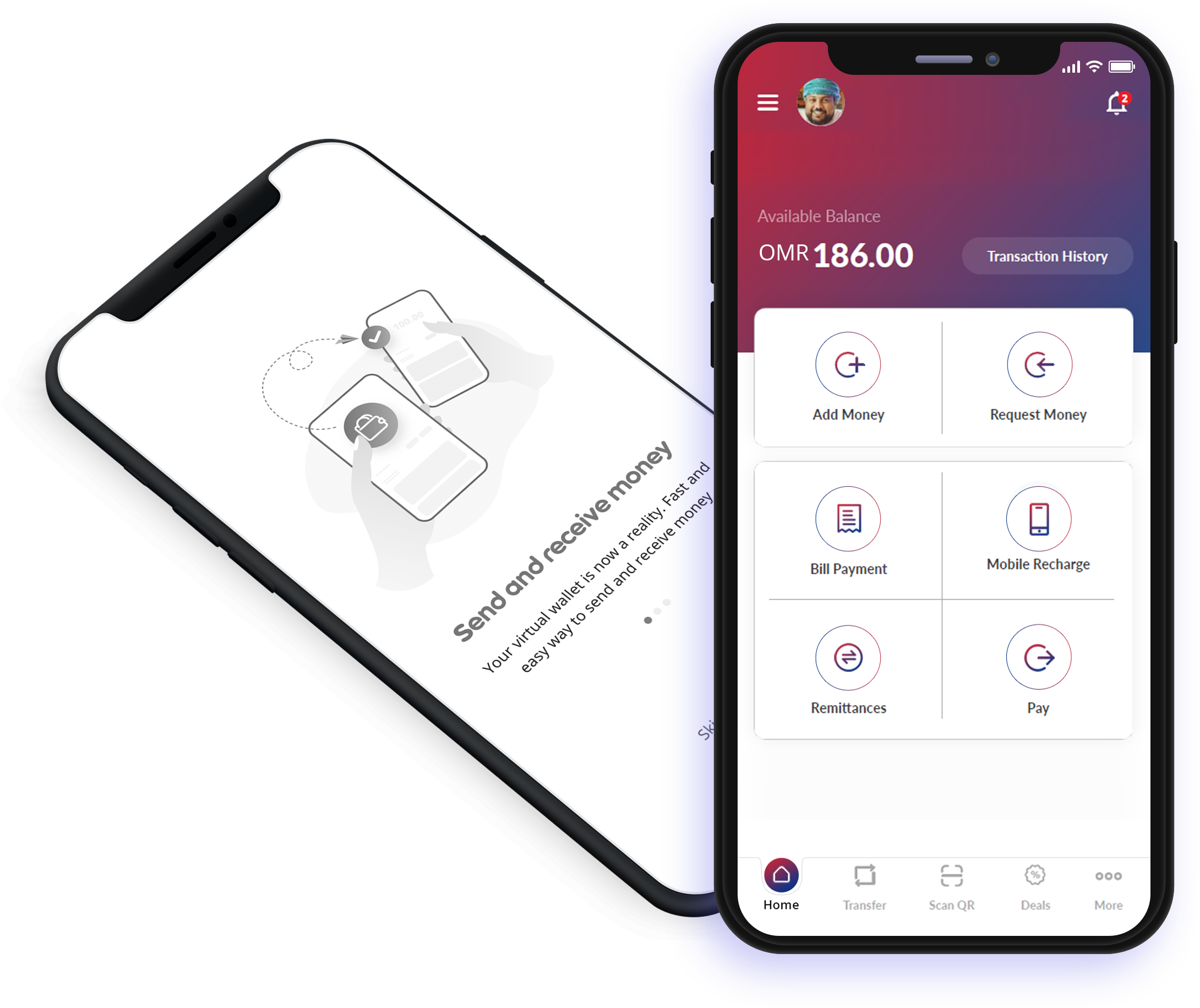

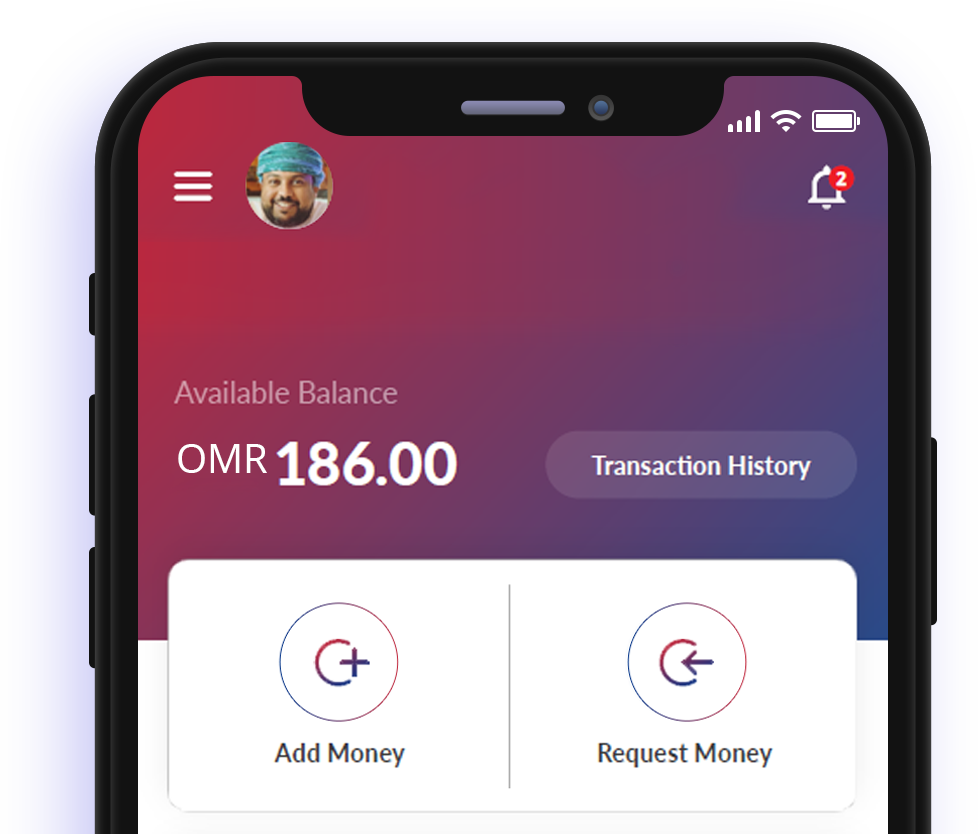

What can Pay+ do?

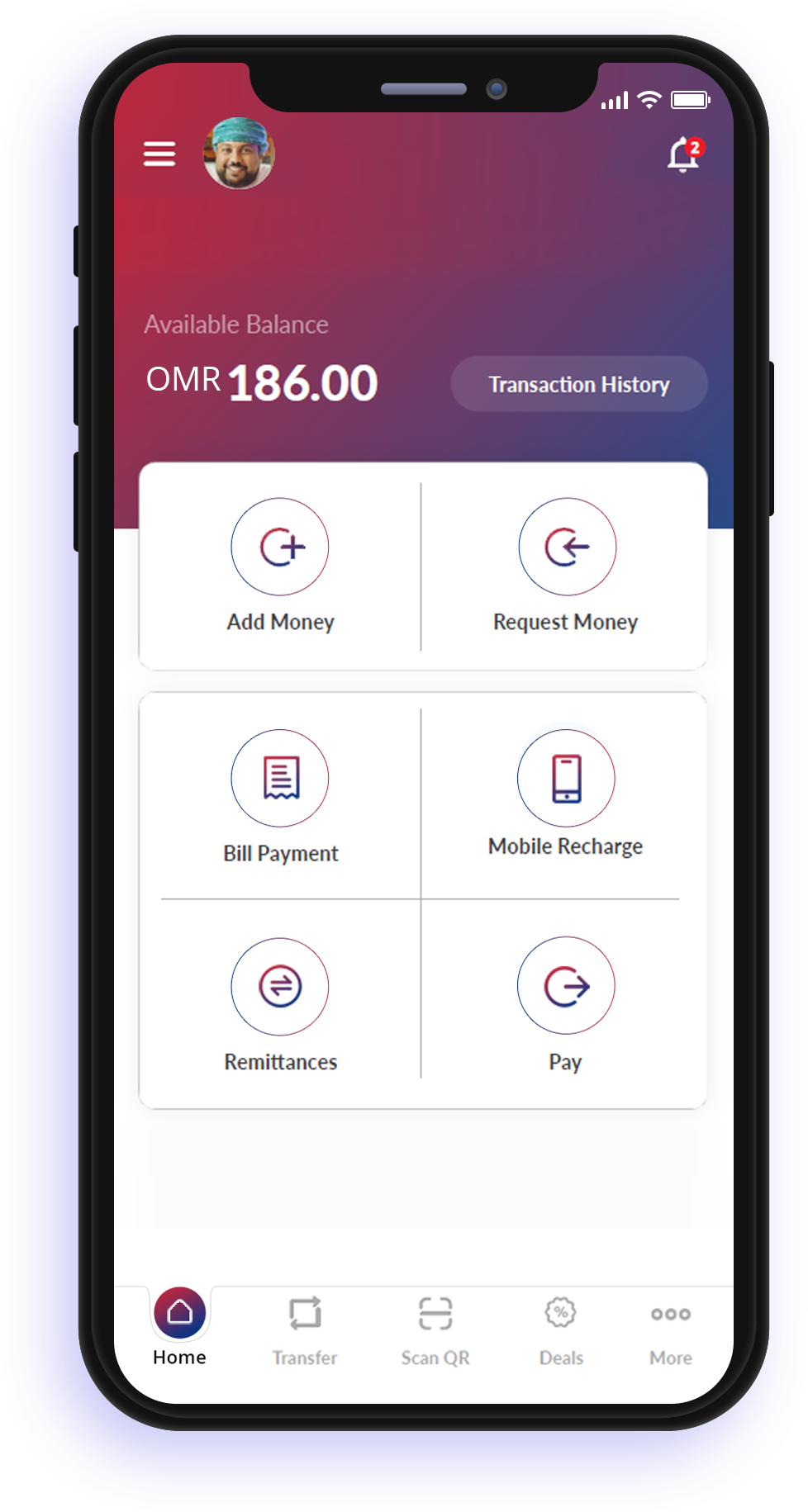

Add money

You can add money to Pay+ through any local debit card or by visiting your nearest Ooredoo store.

Pay at merchants

Use your phone to pay in restaurants and stores and with a faster checkout process using Pay+.

Local money transfers

Pay+ offers a fast, simple and secure way to send money to friends and family in Oman.

You can now transfer money from your Pay+ Wallet to:

– Any other Pay+ Wallet by simply entering the owner’s mobile number.

– To any local bank account within Oman.

International money transfers

Transfer funds instantly to any bank account in India. We are working on expanding our global network to other countries as well.

Mobile top-ups

Top up your mobile number through Pay+ to all mobile operators in Oman (Ooredoo, Omantel and FRiENDi).

Bill payments

Pay your postpaid mobile bills for any number with any operator through Pay+.

About us

A mobile wallet for your daily payments wherever you are. In line with the country’s vision to progress and diversify digital services; Ooredoo Oman and the National Bank of Oman (NBO) have joined forces to bring you Pay+.

Our vision is to pioneer the delivery of financial services and unlock new possibilities for customers. We share a future vision with customers and businesses to provide new and innovative technologies and digital payment experiences.

By leveraging Ooredoo’s vast network and NBO’s banking expertise, we are able to empower merchants and customers through our secure digital wallet solution, Pay+, enabling quick, easy and secure transactions. Pay+ is approved by the Telecommunications Regulatory Authority (TRA) in Oman and endorsed by the Central Bank of Oman.

Merchant Services

Opay is a highly secure digital wallet service that empowers consumers and merchants to take full control and manage their finances anytime. It enables all merchants to track payments, issue instant refund, view dashboard and much more.

Track Payments

Track all the payments you receive, generate and download reports and view a fully robust dashboard.

Instant Refund

You can instantly refund your customers anytime without any hassles.

Quick Onboarding

Onboarding is quick and easy. We are always a tap away and ready to help anytime.

Frequently ask questions

We are here to help

My Account

Add Money / Cash In

You can add money to your Pay+ wallet in multiple ways.

- Add money using any bank card issued in Oman

- Visit your nearest NBO branch or Ooredoo store for an assisted add money transaction

- Visit your nearest NBO CDM and deposit money into your Pay+ wallet.

Yes. The CBO has mandated guidelines on wallet balances.

For full KYC accounts – the maximum allowed balance is OMR 500.

For simplified KYC accounts – the maximum allowed balance is OMR 250.

Pay / Send Money

Please refer to the Transaction fees matrix for details.

Bill Payments

Transfers to a Bank Account

Payments to Merchants

General

How to register

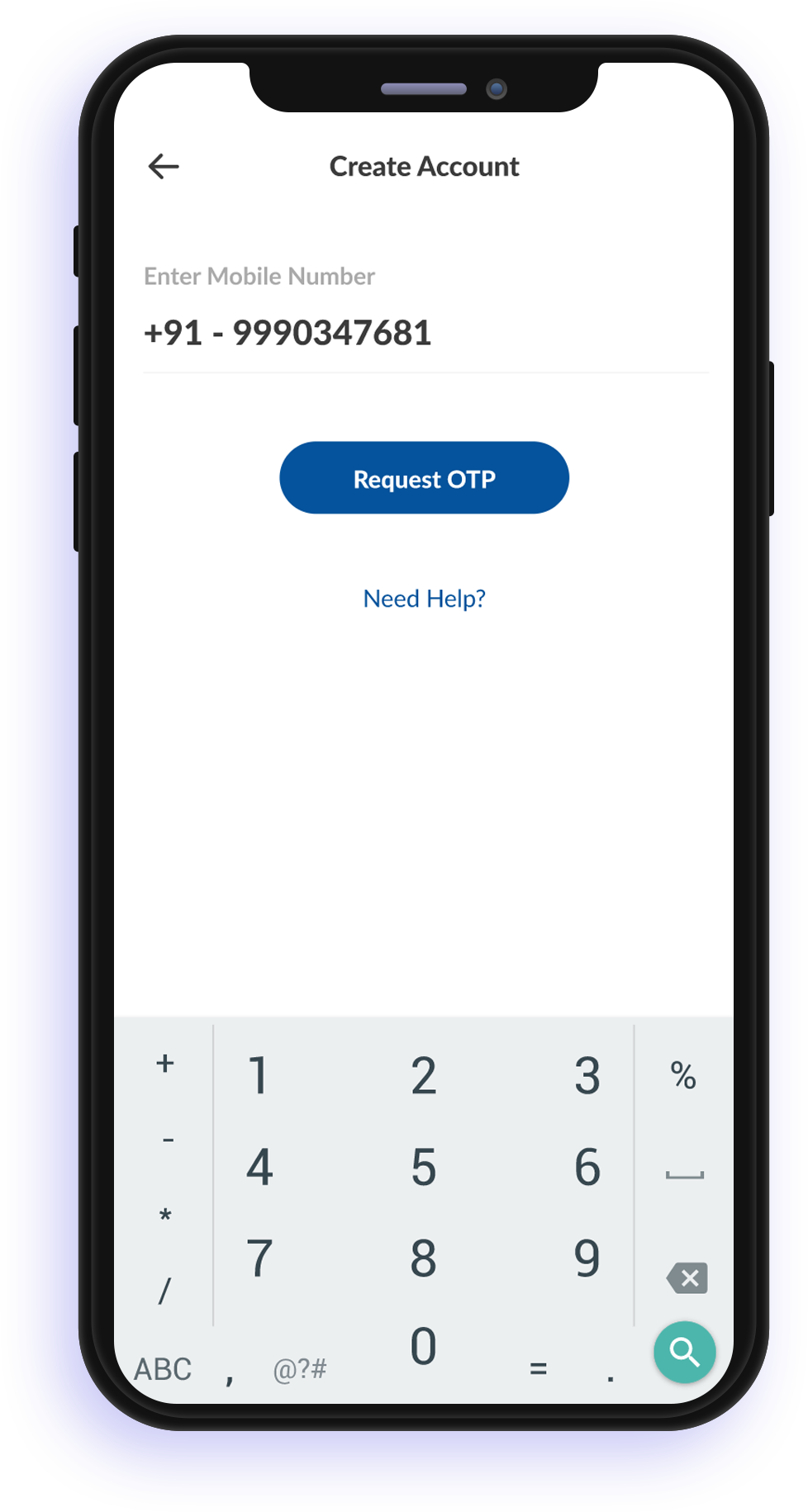

Android users can head to the Google Play Store (link to be included here) to download and install the Pay+ application.

iPhone users can visit the App Store (link to be included here) to download and install the Pay+ application.

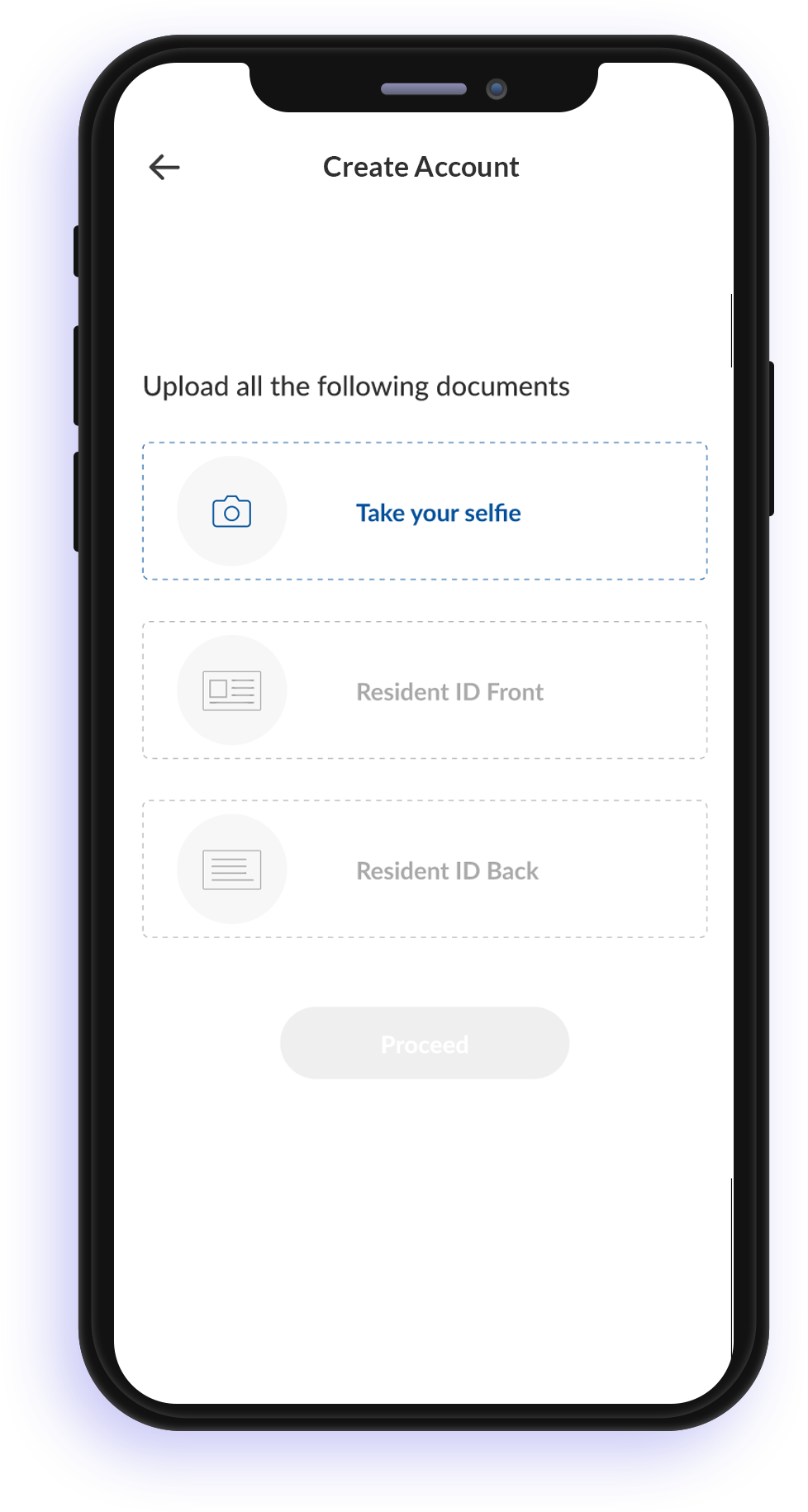

- 1. Download and install the Pay+ mobile wallet application from Google Play or Apple App Store.

- 2. Select ‘Create Account’

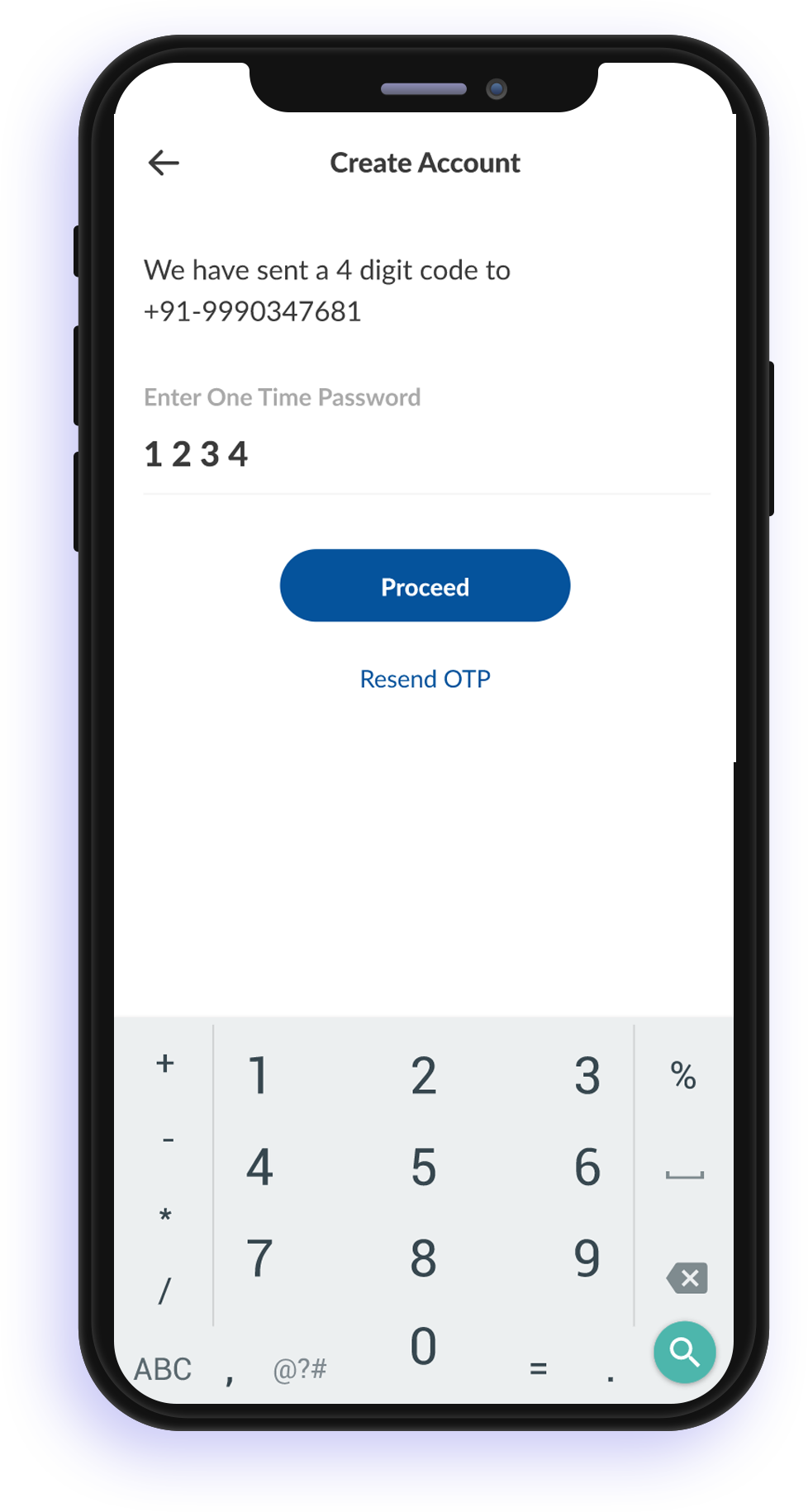

- 3. Enter your mobile number and verify your mobile number with the given OTP code.

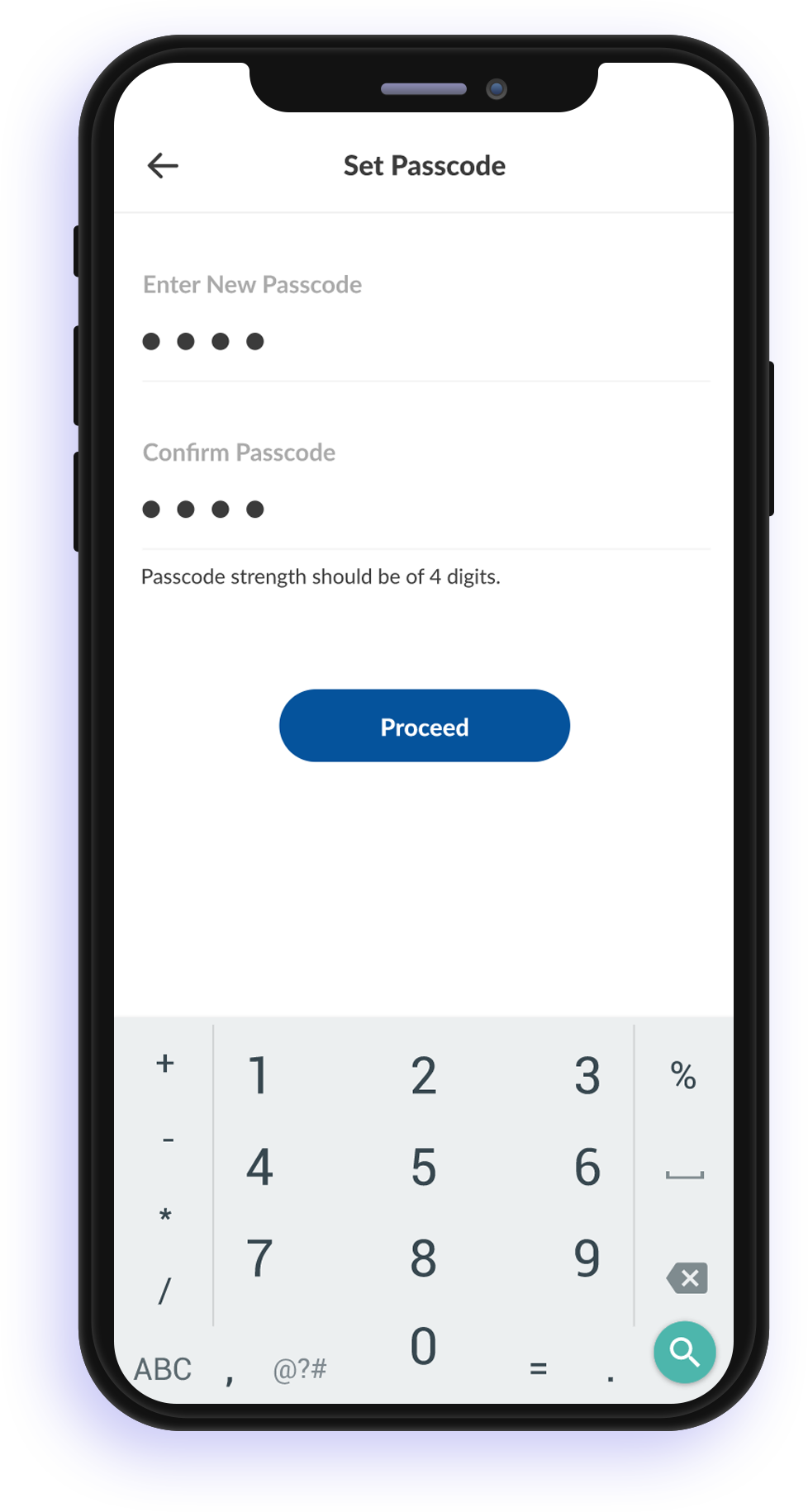

- 4. Set your passcode.

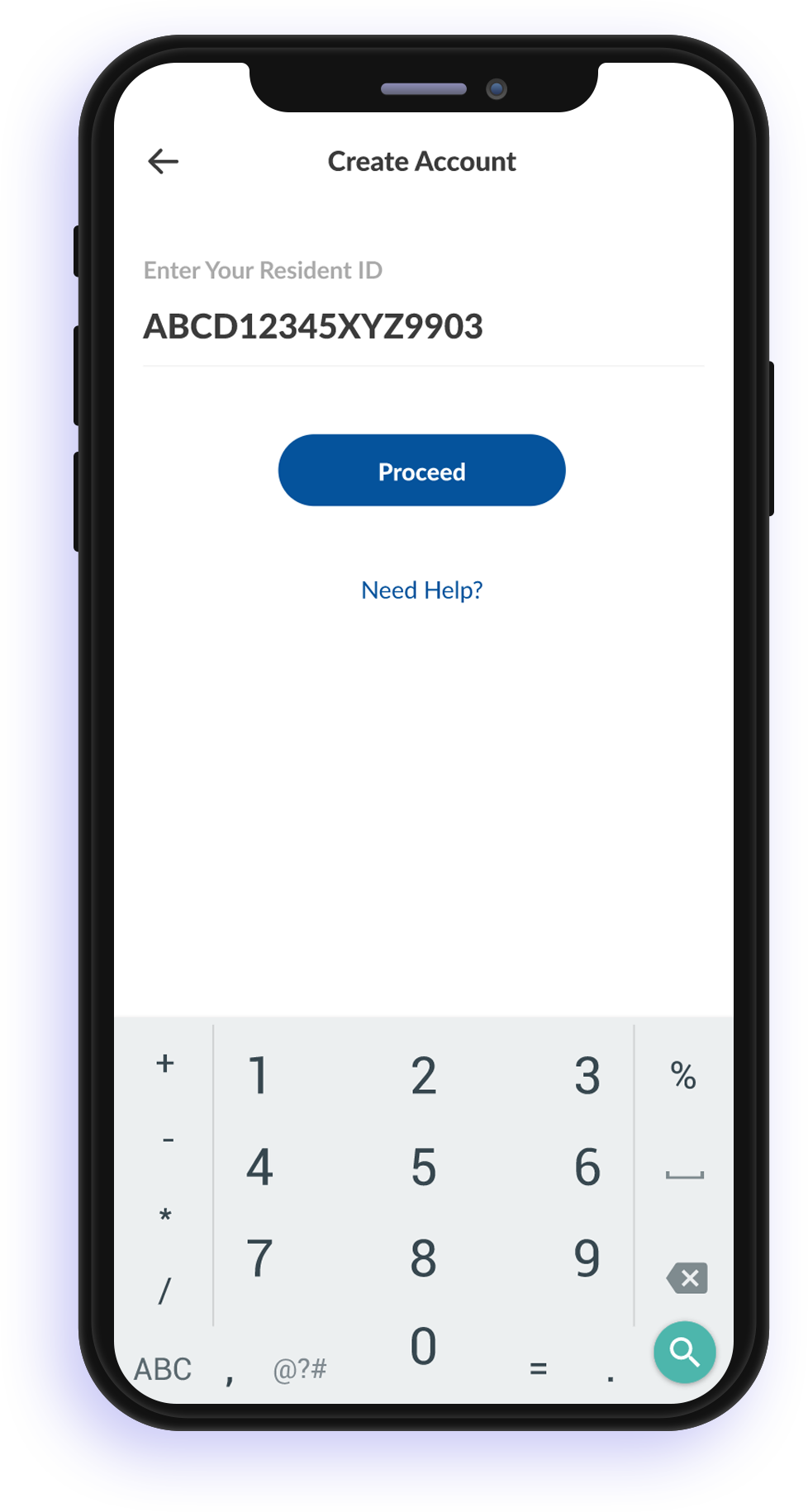

- 6. Enter your ID number and upload ID images and a smart (is this necessary?) selfie.

- 6. The application will automatically scan your ID image and populate the relevant details.

- 7. Verify and click on submit.

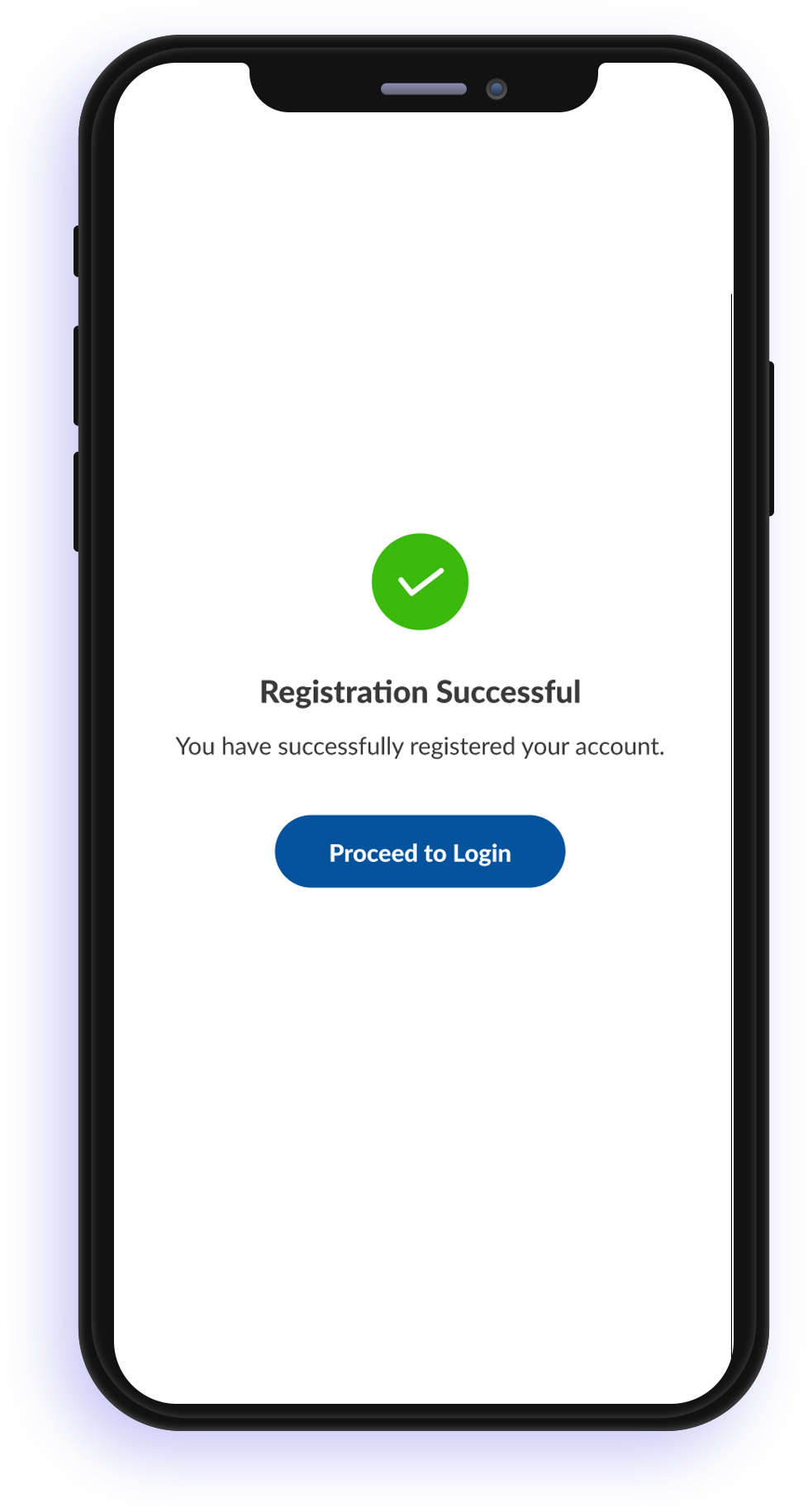

- 8. A successful registration completion message will be displayed.

Set An Alias Name

This is an option to set an alias name for your Pay+ wallet account. An alias name helps to mask account details, including mobile number and ID number.

For sending and receiving money, you can then just provide your alias name to make transactions.

The alias name will be in the format of xxxxxxxx@ Pay+ where xxxxxxx can be a combination of letters and numbers.

This will be unique identificationyou’re your Pay+ wallet account.

Security

We take your security seriously.

Pay+ protects your payment information with industry-leading security technologies to ensure privacy of payment transactions.

GETTING STARTED

Whether you’re on iOS or Andriod, its simple to register for and install Pay+. All you need is a phone with a camera, a National ID and 2 minutes of your time to download your ticket to easy payments.